email: info(at)go-eu.com

phone: +49 (0)89 90 42 23 60

assisted in a company setup.

We answer all your questions about a company setup – free of charge and without obligation.

Inquire now

Over 500 successful foundings. Answer in 24h.

Or give us a call: +49 (0)89 90 42 23 60

(NEW: Company formation including bank account opening 100% remote)

Top 5 Tips: Save Taxes

In this video I will present to you the top 5 examples of how you can save taxes in Romania as a company or as a self-employed person, compared to a Western European country like Germany.

1. Reduce personnel costs

For most companies, personnel costs are the largest expense. If you manage to reduce these significantly, you can greatly increase your profit and thus your return.

In Western Europe, personnel costs are very high, especially in sought-after fields such as IT, marketing or engineering. But personnel costs in other areas can hardly be reduced due to regulations such as the minimum wage.

In general, the average salary in Western European countries is €2,860 gross per month.

The situation is completely different in Romania. The average salary here is just around €400 a month. This means that labor costs in Romania are significantly lower, yet the quality of work remains high. Romania is home to an exceptionally high number of well-trained staff, particularly in the IT and engineering fields.

2. Trade Tax

Trade tax is based on the legal form of the company and on the level of the municipality's assessment rate. In Germany, trade tax is mostly influenced by the municipality's assessment rate. In larger cities, which are the most attractive for start-ups, the assessment rate is often over 400%. But even in smaller municipalities, it is never below 200%.

Things are completely different in Romania! In Romania there is simply no trade tax. Nothing needs to be calculated or paid. No matter in which municipality the company is located in Romania, the trade tax is always €0!

3. Corporate Income Tax

In Germany, all legal entities, i.e. GmbH, GmbH & Co.KG, a UG or a stock corporation, must pay corporate tax. The corporate tax rate is 15% nationwide. And these 15% are based on the profit of a financial year. So if a company makes a profit of €100,000, €15,000 of that is corporate tax. This is of course in addition to all other taxes such as trade tax.

Romania also offers great advantages when it comes to corporate tax! In Romania, corporate tax is structured in stages:

If you operate your Romanian company alone and have no employees, the corporate tax is 3% on turnover up to 250,000 Euro per year.

However, if you have one or more employees in your company, the corporate tax is only 1% on sales up to 250,000 Euro per year.

Just imagine! Only 1% tax on sales. There are hardly any other business models that can keep up with that. Not even in far away exotic countries...

4. VAT

In principle, sales tax is not particularly significant, as it is only a transit item for the entrepreneur. Sales tax in Germany is generally 19%. In addition, there is the so-called small business regulation. This states that if profits are up to €17,500 per year, no sales tax needs to be shown on invoices.

In Romania, the VAT rate is also 19%. However, there are significant advantages in the small business regulation. Here the tax-free allowance is a full €60,000 per year. (RON 300,000)

Within the EU, this is one of the most liberal regulations for small businesses and thus creates a significant competitive advantage – especially for start-ups and small enterprises.

5. Income tax

In Germany, income tax refers to the income of an individual, i.e. to wages and salary, but also to amounts taken from the company, i.e. payouts.

The amount of income tax depends on the annual income. Many self-employed people end up in one of the highest tax brackets and have to pay up to 45% tax on their income. In Germany, almost half of income goes to taxes.

In Romania, things are much better! The income tax here is 10% flat tax. This means no matter how high the income is, the income tax is always 10%.

So if I want to withdraw €80,000 from my company into my personal assets in Romania, I only have to pay 10% tax on it, so that I still have €72,000 left after taxes. You'll soon see that things are completely different in Germany!

Conclusion

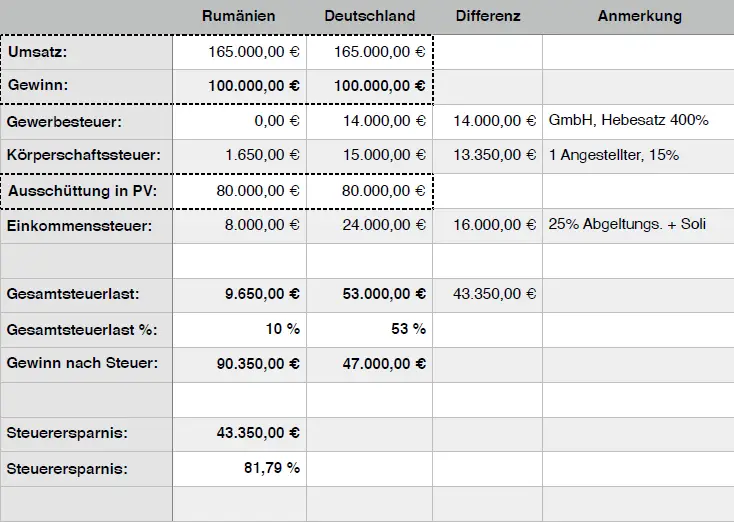

In conclusion, here is a total calculation of the tax burden in Romania and Germany, compared using an example!

I hope you enjoyed this blog post – if you are interested in setting up a company, taxes or real estate in Romania, we look forward to hearing from you.

We answer all your questions about a company setup – free of charge and without obligation.

Inquire now

Over 500 successful foundings. Answer in 24h.

Or give us a call: +49 (0)89 90 42 23 60

(NEW: Company formation including bank account opening 100% remote)

Jochen

Published on 30 December, 2019 / Answer

Interesting approach to reducing the tax burden. Setting up an EU company, in this case in Romania, can make sense. Romania and Bulgaria are also the leaders in the EU with the lowest taxes. Small note: The €70,000 tax allowance for small businesses per year is not entirely correct. This may have been the case 1-2 years ago. RON 300,000 is the tax allowance - this corresponds to around €64,000. Otherwise, great input and great content!

Thomas Hofmann

Published on 02 January, 2020 / Answer

Thanks for your advice! You are absolutely right: there is a 300,000 LEI allowance/year for small businesses/VAT free. Depending on the exchange rate, this is a little under 70k EUR. Good point!

Oliver

Published on 14 January, 2020 / Answer

I have already traveled to Romania three times myself. I have always liked the country and the people. The tax burden in Germany is outrageous, as you can see from the table. The tax office is your faithful companion your whole life anyway, but to such an extent...wtf:) Romania is a real option. I'll keep that in mind!

Georg Lafer

Published on 27 October, 2022 / Answer

The tax savings are enormous. Maybe one day I’ll warm up to the idea of Romania. What would take me 30 years to accumulate in Germany, I could achieve in less than 10 years in Romania. So I've been working for the German state for more than 20 years of my life! It's absurd - but anyone who says otherwise is ignorant.

Calvin Kunz

Published on 21 September, 2024 / Answer

Great! I would love to do this personally and just have more money in my pocket.

Gerald

Published on 27 March, 2025 / Answer

I liked the direct comparison, but everyone knows Germany is very expensive in general. It was not surprising for me..

Leave a comment