email: info(at)go-eu.com

phone: +49 (0)89 90 42 23 60

assisted in a company setup.

Update 2025 : 10 Minutes initial consultation, 100% free.

Inquire Now

Call us: +49 (0)89 90 42 23 60

TOP 5 Disadvantages: Setting up a holding company. Hardly any advantages.

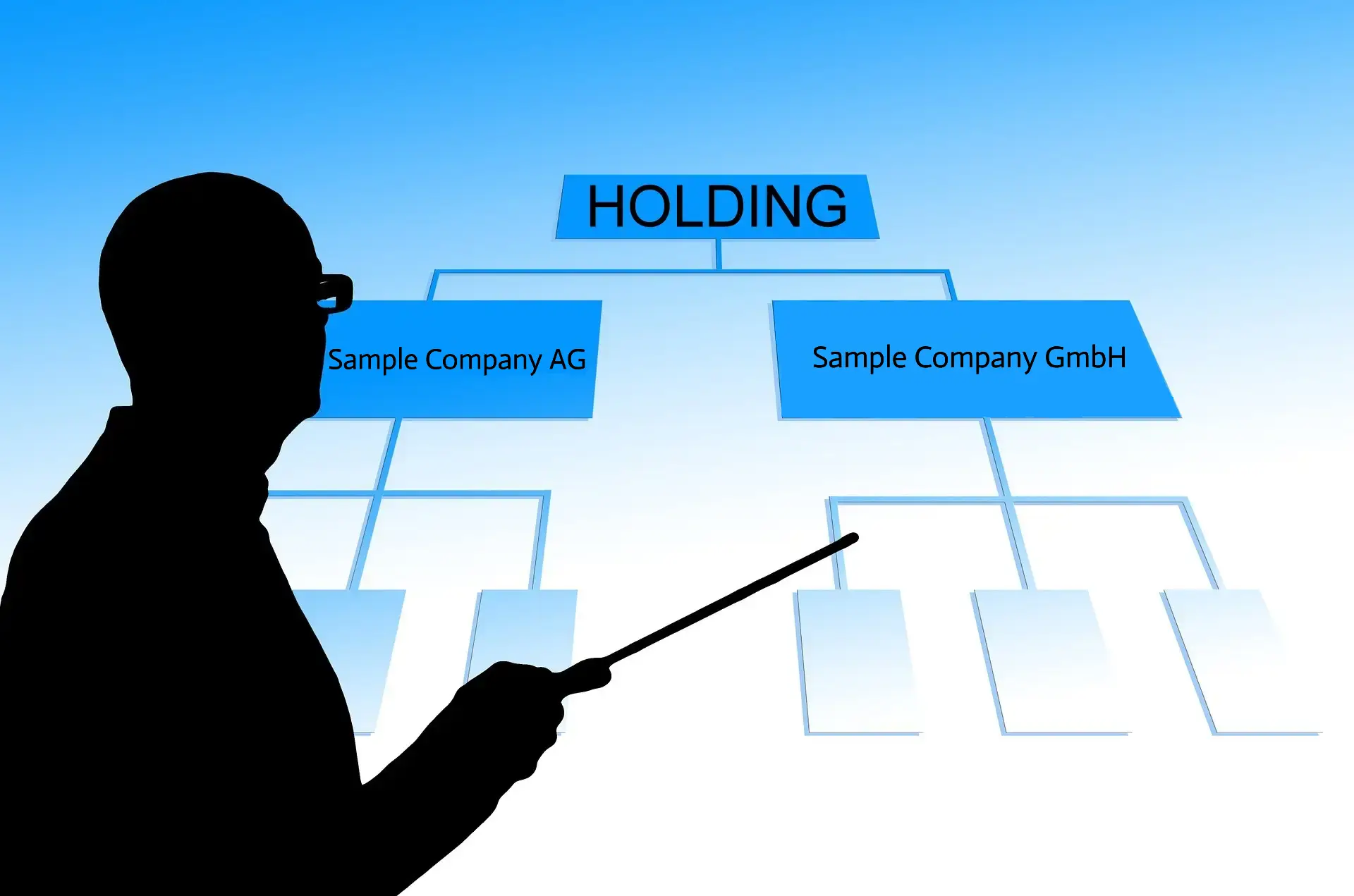

23 March 2025 11715 8A holding company is a specific structure consisting of multiple companies (or Limited Liability Companies),

but it is not a legal form of its own. This means that when people refer to a holding company

in everyday language, they are actually talking about a holding structure.

The setup involves multiple companies arranged in a hierarchical structure.

You can compare it to a coat:

There is therefore at least one parent company – the controlling parent company. This holds shares in subordinate companies – the so-called

subsidiaries.

So what is a holding company actually set up for, why do you need it?

Typically, a holding company is used to bundle different company shares or businesses and manage them through the parent company, i.e., the holding company.

Asset accumulation and asset protection? These are all keywords that are attributed to a holding structure.

But is this really the case? Does this make sense for every business owner? We'll look at the 5 biggest disadvantages:

Of course, there are other ways to make smart use of a holding company, such as benefiting from a 1.5% tax on share profits instead of 26%. But how do you get the money out of the holding company? You don’t! Unless you pay the capital gains tax of 26% or income tax at your personal tax rate .

Can't I pay only 1-10% tax 100% legally, with little effort and cost? Without a holding company?

Yes, you'll find out in our video! Or read on in the blog.

Here are the TOP 5 mistakes when founding a holding company

1st Mistake: Additional start-up costs, double-entry bookkeeping and increased administrative effort.

Multiple accounting departments: If a holding company is founded, a tax group is created.

The accounting becomes more complicated and requires more effort. This also increases

the complexity of the accounting and the workload for the tax advisor.

- Costs of setting up several companies as well as tax and legal advice: approx. EUR 1,000 per

company

- Additional costs and expenses for additional accounting, balance sheet and preparation of several annual financial statements for all companies approx. EUR 2,000-5,000/year

- When founding a LLC: Payment of the share capital in the amount of EUR 25,000

Overall, the organizational effort increases because not only do you have to manage one or

more companies in parallel, but you also have to keep an eye on the bigger picture. In

addition, more or less strict contracts are usually required between the holding company

and the individual subsidiaries, to regulate aspects such as personnel, marketing and/or

purchasing conditions.

Multiple companies can lead to high incorporation costs. At least a five-figure sum must be invested in order to establish a holding company with two LLCs.

2nd Mistake: Liquidation costs

There is no guarantee that a company will be successful, especially if it is a new start-up. In the event of failure, it is necessary to liquidate several companies. Liquidating several companies means additional costs and a significant administrative burden.

Delay in liquidity: If you do not submit a written declaration to the tax office in which you explain the purpose and organization of the tax group or holding structure, this will slow down the process of obtaining the VAT identification number, therefore preventing you from starting business operations. Due to lengthy registration procedures, liquidity delays of up to several months must be expected. This typically also applies when restructuring an existing holding structure if an operational LLC is already in place.

3rd Mistake: At least 5 years of profit transfer

The holding structure only exists if the profits and losses of all subsidiaries have been transferred to the parent holding company for at least 5 years.

In order to be recognized for tax purposes, the profit transfer agreement must be effectively agreed and concluded for at least five years.

If a profit transfer agreement is not implemented in a year, it is considered ineffective for tax purposes from the outset. If the profits or losses are not transferred to the exact cent, this group fails. The holding company would therefore lose its purpose.

"How can you fight against bureaucracy? Do you comply with all the regulations and pay all your taxes in your country of residence?"

4th Mistake: Accounting errors and the inability to offset losses

The transfer of incorrect profit or loss due to accounting errors of just one cent can dissolve the holding structure. This means that you lose your tax advantages straight away..

The use of losses from previous years to reduce taxes according to Section 8d of the Corporate Tax Act is not possible for a holding company. This disadvantage should be carefully considered, not just when establishing a holding company.

5th Mistake: Legal uncertainty due to incorrect application

Legal uncertainties or errors in law application can cancel or interrupt the holding company's tax group status.

If, for example, incorrect assumptions were consistently made, such as the transfer of an incorrect result, the immediate return of profits after transfer to the holding company, etc. - this could lead to a retroactive denial or interruption of the holding company under tax law. In the worst case, taxes would then have to be recalculated and paid. The tax advantages could therefore be lost for the entire period of application.

So now, as already announced, on to asset accumulation and asset protection of the holding structure.

The accumulation of assets or the retention of profits (i.e. no distribution of surplus over the years) is exactly the same in the operating LLC and in the parent holding company.

And now, after 10 years, for example, you would like to distribute your profits to your personal assets. 26% capital gains tax is then due, regardless of whether it is an operating LLC or a holding LLC.

So why all this? It's clearly about protecting assets. The retained or accumulated profits remain in the parent holding company, even if the operating company goes bankrupt.

You have to be able to afford not to pay out any profits for years, ideally until retirement age. And you have to bear the considerable additional costs of several thousand euros per year. It is said that a holding structure only pays off if you have a profit of 2-5 hundred thousand euros per year.

This raises the question: if I am already generating good sales and making decent profits with my company, is it really worth setting up a holding structure with all its costs, effort, and risks? I pay 30% corporate tax and 25% capital gains tax on profit distributions, regardless of whether I have a holding structure or not. There is no way around it. That adds up to a total tax burden of around 50%. On top of that, there’s the 19% VAT, which many people ignore, even though it’s essentially a pass-through item. The fact is, at some point, it has to be paid—whether at the purchasing stage or at the end of a long value chain.

If you are now at the point where you really want to make a change to your company's high tax burden or even have an alternative to paying only a fraction of the taxes before you start your company, then listen more carefully now.

Didn't we talk about an alternative at the beginning – with an alleged tax burden of only 1%? Absolutely right. Congratulations on making it to this part of the article.

For all entrepreneurs and self-employed people who are looking for a way to save taxes, we at GO EU offer a solution that is fully recognized by the local tax office and does not require any change of residence. This is our 1% tax model!

With the 1% tax model, you only pay 1% tax up to an annual turnover of 250.000 Euros and are even exempt from sales tax for a turnover of up to 60,000 euros per year.

And all of this within the EU, without dubious grey areas, shady offshore structures or having to relocate your place of residence. This model is fully recognized by your local tax office, and you can even have this recognition confirmed in advance!

Does this sound interesting to you? Then click on the link below "Inquire now"! We look forward to hearing from you!

Update 2025: 10 Minutes initial consultation, 100% free.

Inquire Now

Alfred Pauli

Published on 09 November, 2023 / Answer

Everyone talks about a holding company or VV GmbH and how great it is for saving taxes. But no one tells you about the additional costs of maintaining two companies and that I can't get the money out of the holding company at all - unless I pay 26% capital gains tax. Extra costs without much added value.

Karl Lobinger

Published on 10 November, 2023 / Answer

1.5% tax on share profits and 1.5% tax on company sales - that is the added value.

Marcel

Published on 10 November, 2023 / Answer

Yes, that's all well and good, but I pay just as much and even more in total if I want to distribute profits from the holding company. I pay the running costs of the second company + the same tax that I would otherwise pay with just one company. Waiting until retirement age is only an option for very few. Should I set up a company in Romania before emigrating?

Thomas Hofmann

Published on 10 November, 2022 / Answer

Setting up a company within the EU is a normal process and happens frequently every day - even if the founder's main place of residence is not in the country of establishment - but in the home country. It is advisable to set up the company before emigrating. This way, you are already doing business and can then easily take care of emigrating without any pressure.

Johannes

Published on 11 November, 2023 / Answer

I don't necessarily want to emigrate to Romania. Can I legally run a Romanian company from Germany?

Thomas Hofmann

Published on 11 November, 2023 / Answer

This depends on a number of different factors. In principle, it is very easy to set up a company remotely. Operating a foreign company from your home country requires building up the necessary substance. If this is sufficiently present, there are no major obstacles to recognition.

Ullrich

Published on 12 September, 2024 / Answer

Thank you for the enlightening article. Finally someone who reveals the truth about the myth of holding.

Kevin

Published on 22 March, 2025 / Answer

Didn’t realize how quickly the costs can outweigh the benefits with a holding setup. Definitely not as straightforward as it’s often sold.

Leave a comment