email: info(at)go-eu.com

phone: +49 (0)89 90 42 23 60

assisted in a company setup.

Table of contents:

Lowest Tax Countries in Europe - Top 10 Guide 2026

08 january 2026 3697 4How to Read This Guide

Many entrepreneurs search for “lowest tax in Europe” and assume it’s purely about a headline corporate tax rate. In 2026, that approach is outdated. The safest way to choose a low-tax country is to look at the full picture:

- Corporate tax + dividend tax + income tax (total burden, not just one number)

- EU market access (if your clients are in the EU)

- Residence + presence requirements (from 0 days per year to a minimum presence/year)

- Further tax optimisaion possible (yes or no)

- Steadiness and foreseeability (tax rules that don’t change every year)

The list below is therefore ranked by overall tax efficiency + practicality, not by headline tax alone.

We answer all your questions about a European Company Setup – free of charge and without obligation.

Inquire now

Over 500 successful foundings. Answer in 24h.

Or give us a call: +49 (0)89 90 42 23 60

(NEW: Company formation including bank account opening 100% remote)

Top 10 Lowest-Tax Countries in Europe (2026)

1) Bulgaria 🇧🇬 EU member

Bulgaria remains one of the most consistent low-tax jurisdictions inside the European Union, attractive for operating companies, holding structures, and internationally active digital nomads. What makes Bulgaria clearly the number 1: Taxes can be reduced to 10% in total without being a resident in Bulgaria and with a residency permit to 7,5% total tax.

- Corporate income tax: 10% flat

- Dividend tax: 5%

- Personal income tax: 10% flat

- Residence required: no

- Presence in Bulgaria required: no (Even with being a resident in Bulgaria, no presence is mandatory)

- Tax optimisation possible? Yes, the tax burden can be even lowered with the right structure

❌ Before tax planning

- Bulgaria company: 10% Corporate tax + 5% Dividend tax = 15% tax total

✅ After tax planning:

1. Without residency: 10% tax total

2. With residency: 7,5% tax total

➼ Further information:

➔ Company setup Bulgaria: Company formation Bulgaria in 5 steps➔ Latest Taxes in Bulgaria: Taxes Bulgaria 2026

➔ Foreigner Guide: Business Bulgaria as foreigner

➔ Company forms: Bulgaria EOOD

➔ Bookkeeping: Accounting Services Bulgaria

➔ Residency: Residence Permit Bulgaria

We answer all your questions about a European Company Setup – free of charge and without obligation.

Inquire now

Over 500 successful foundings. Answer in 24h.

Or give us a call: +49 (0)89 90 42 23 60

(NEW: Company formation including bank account opening 100% remote)

2) Romania 🇷🇴 EU member

Romania is known for micro-company regimes that can reduce effective taxation for qualifying businesses, especially smaller service companies and startups. Second place might be surprising as taxes have been raised over the last years. The approval from the Romanian tax authorities through our tax planning (ANAF), a total tax of only 10% is possible (we use it ourselves) instead of 19-32% in total.

- Micro-company tax: 1%–3% on turnover (if eligible)

- Standard corporate tax: 16%

- Dividend tax: 16%

- Personal income tax: 10% flat

❌ Before tax planning

- Romania micro company: 3% Corporate tax + 16% Dividend tax = 19% tax total

- Romania company: 16% Corporate tax + 16% Dividend tax = 32% tax total

✅ After tax planning:

1. Without residency: 10% tax total

2. With residency: 10% tax total

➼ Further information:

➔ Company setup Romania: Company formation Romania in 5 steps➔ Foreigner Guide: Business Romania as foreigner

➔ Client Review: Company opening Romania review

➔ Latest Taxes in Romania: Taxes Romania 2026

3) Hungary 🇭🇺 EU member

Hungary has the lowest headline corporate tax rate in the EU, making it a serious option for operational businesses where profits are retained or reinvested. Hungary has the lowest corporate tax rate without a threshold, at 9%. That's a fact. Other taxes, like the 15% dividend tax, make it less tax-friendly to view it as a whole. With tax planning from GO EU, only 15% tax in total is possible, all ruled out with the Hungarian Tax authorities legally. (A residency permit is mandatory to do so)

- Corporate income tax: 9%

- Dividend tax: 15%

- Income tax: 15%

- VAT: 27%

❌ Before tax planning

- Hungary company: 9% Corporate tax + 15% Dividend tax = 24% tax total

✅ After tax planning:

1. Without residency: 15% tax total

2. With residency: 15% tax total

➼ Further information:

➔ Company setup Hungary: Company formation Hungary in 5 steps4) Serbia 🇷🇸 Not EU

Serbia has one of the best tax rates for small companies in Europe, making it a serious option for operational businesses with smaller revenues. Foreigners, whether EU or non-EU citizens, can form and fully own a company or a sole proprietorship in Serbia without having a Serbian residence permit or living in Serbia. There are no legal limits preventing non-residents from registering businesses.

- Corporate income tax: 15%

- Dividend tax: 20%

- Income Tax: 10-20%

- VAT: 20%

❌ Before tax planning

- Serbia company: 15% Corporate tax + 20% Dividend tax = 35% tax total

✅ After tax planning:

1. Without residency: 10-20% tax total

2. With residency: 2-10% tax total

5) Croatia 🇭🇷 EU member

You do not need to be a resident of Croatia to open and own a company there.

Foreigners (EU and non EU) can form a Croatian company without being residents.

Physical presence in Croatia matters for forming a Croatian company, a Croatian residence permit, particularly for temporary residence permits based on employment, business activity, or self-employment

- Corporate income tax: 10-18%

- Dividend tax: 12%

- Personal Income tax: 17-35%

- VAT: 25%

Best for: manufacturing, trading, EU operational companies, and groups optimizing corporate tax.

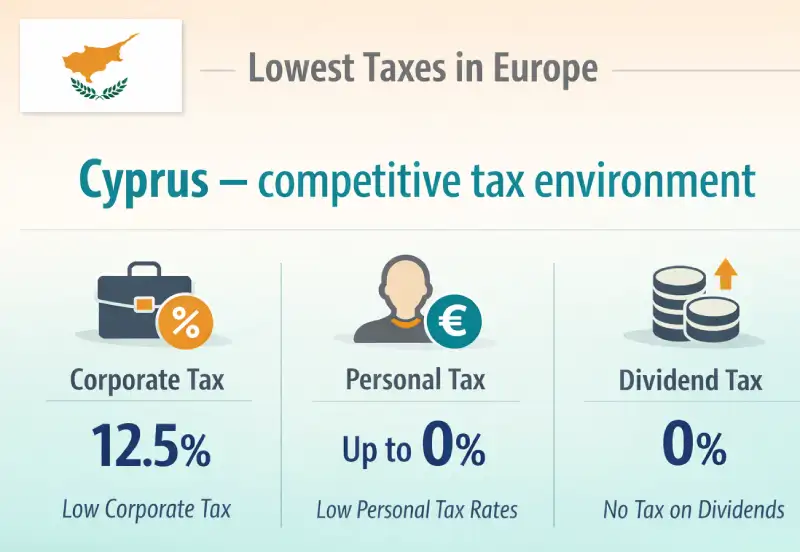

6) Cyprus 🇨🇾 EU member

Cyprus is a classic EU hotspot for international businesses, thanks to its effective corporate tax rate and strong network.

It can be effective for holding companies, IP boxes, and cross-border structures when substance is planned accordingly.

Cyprus allows non-residents (EU or non-EU) to incorporate and fully own a company, without holding a residence permit or living in Cyprus.

Anyone can register a company, and foreigners can act as both shareholders and directors.

Temporary residence permits like the Pink Slip allow you to stay in Cyprus for extended periods, but they are designed for people actually residing in the country beyond tourist stays.

- Corporate income tax: 12.5%

- Dividend tax: often 0% for certain non-dom scenarios (case-specific)

- Legal environment: widely used in international structuring

Best for: international holdings, cross-border structures, and founders who need EU credibility and professional infrastructure.

We answer all your questions about a European Company Setup – free of charge and without obligation.

Inquire now

Over 500 successful foundings. Answer in 24h.

Or give us a call: +49 (0)89 90 42 23 60

(NEW: Company formation including bank account opening 100% remote)

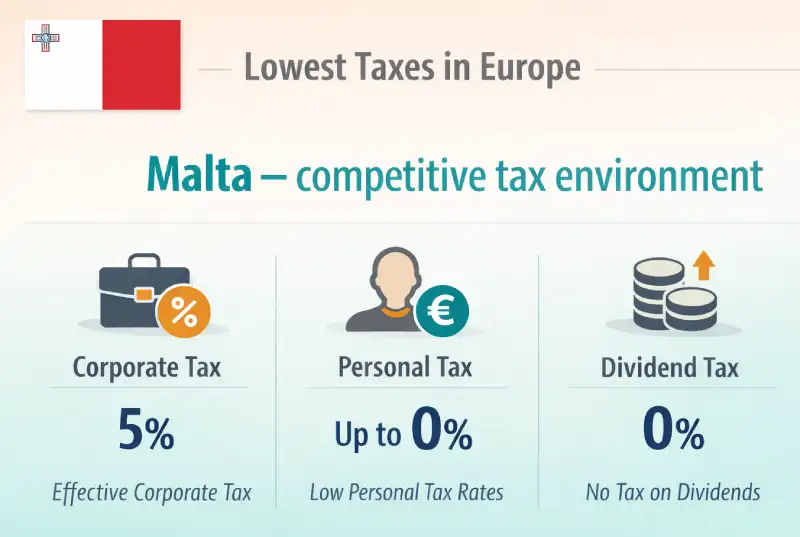

7) Malta 🇲🇹 EU member

Malta is often known for international structures. While the nominal corporate tax rate is high, effective taxation can be

lower through Malta’s refund mechanisms, but this needs really professional support.

Foreigners (EU or non-EU) can fully own and register a Maltese company without living there or holding a Maltese residence permit.

For a normal temporary or ordinary residence permit, Maltese authorities expect you to live in Malta because the purpose of these permits is actual residence in the country:

- Nominal corporate tax: 35%

- Effective tax (common ranges): often ~5–10% (structure-dependent)

- Setup note: not a “DIY” jurisdiction

Best for: international companies with professional compliance, founders needing an EU structure tax results tax outcomes.

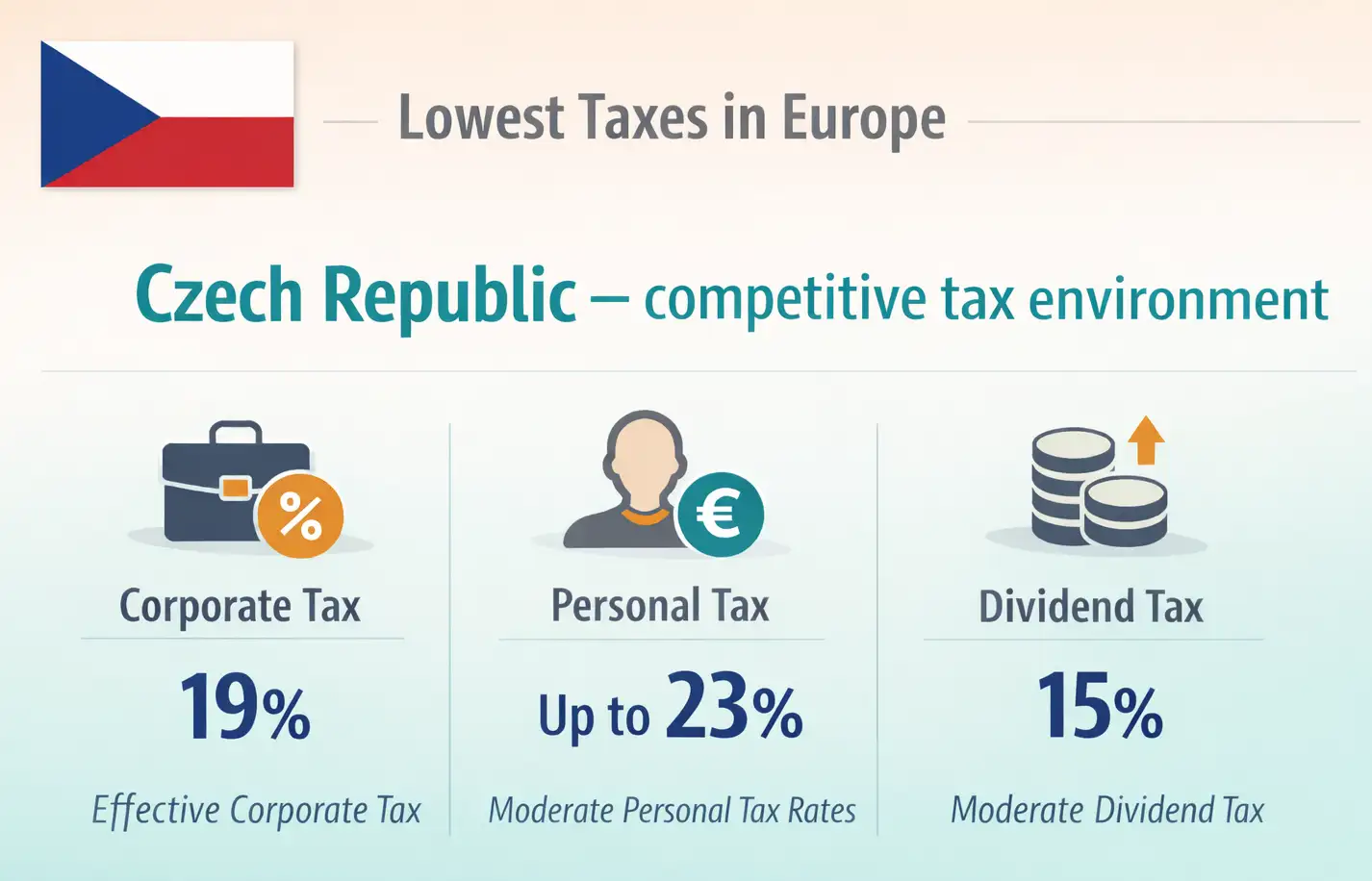

8) Czech Republic 🇨🇿 EU member

Not the lowest-tax jurisdiction, but due to a very stable environment, EU credibility, and overall business

strength. In practice, it can be competitive for real operational companies.

Foreigners (EU or non-EU) can open and fully own a Czech company (such as an s.r.o.

- the Czech limited liability company) without living in the country or holding a Czech residence permit. Founders and directors do not have to be residents.

There is no fixed “minimum days abroad” number stated in the law, but if you stop meeting the permit’s purpose and are absent long-term,

renewal or even validity can be jeopardised because the purpose of your stay must still exist.

- Corporate income tax: ~19%

- Dividend tax: often ~15% (structure-dependent)

- Strength: stability, strong economy, central location

Best for: operational EU businesses ability, reputation, and, reputation, and a strong local economy.

9) Lithuania 🇱🇹 EU member

Lithuania combines moderate tax rates with a modern environment and is growing, and is increasingly popular for

tech startups, fintech banks, and international services.

Foreigners (EU and non-EU) can establish (incorporate) and fully own a Lithuanian company without residency and do not have to live in the country to register the business.

Lithuanian authorities require you to be part of, either by actively managing or participating in your company. If the stated purpose for immigration concerns to exist, such as having no activity or physical presence, your renewal could be denied.

There isn’t a published “minimum days per year” rule like in some countries,

But an extended absence the activity for which activity for which the residence permit was granted can lead to the refusal of renewal or even to cancellation.

- Corporate income tax: ~15% (reduced rates may apply for small companies)

- Strength: growing ecosystem and EU credibility

Best for: tech and service businesses that need an EU structure, stable compliance, and a modern business ecosystem.

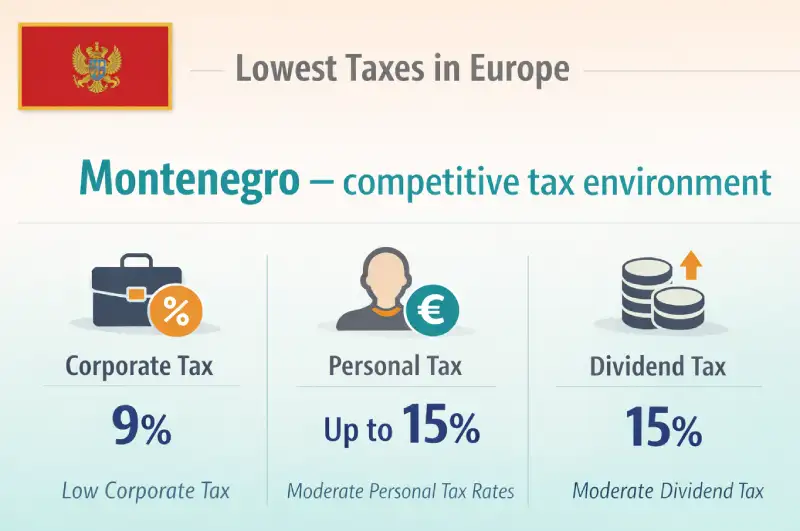

10) Montenegro 🇲🇪 Not EU

Montenegro is Europe-only but not an EU member (candidate country). It to reduced corporate due to low corporate taxes and a

relatively straightforward system. It can work for Europe-focused structures that do not depend on EU benefits. Foreigners and non-residents can incorporate a business there under the same conditions as locals.

You can set up a company remotely, often via power of attorney, without physically being in Montenegro.

There are no legal requirements that directors or shareholders must be Montenegrin residents to register a company. Company ownership does not, in itself, make you a resident. To live in Montenegro legally,

you have to apply for a residence permit, which typically requires additional steps such as being employed by the company as its director and meeting immigration requirements.

- Corporate income tax: commonly 9%–15% (depending on bracket/structure)

- EU member: no (EU candidate)

- Use case: non-EU operational structures, regional planning

Best for: founders who want Europe-based low-tax operations without requiring EU legal/tax benefits.

Quick Comparison Table

| Country | Corporate Tax | Dividend Tax | EU Member | Minimum Stay |

|---|---|---|---|---|

| Bulgaria | 10% (flat) | 5% | Yes | 0 days/year (also with residency) |

| Romania | 1–3% (micro) / 16% | 16% | Yes | 0 days/year (also with residency) |

| Hungary | 9% | 15% | Yes | 0 days/year (also with residency) |

| Serbia | 15% | 20% | No | 0 days/year (also with residency) |

| Croatia | 10-18% | 12% | Yes | 0 days/year (also with residency) |

| Cyprus | 12.5% | Often 0% (case-specific) | Yes | Min. 60 days/year (with residency) |

| Malta | 35% nominal / ~5–10% effective | Varies | Yes | Min. 90-180 days/year (with residency) |

| Czech Republic | ~19% | ~15% | Yes | 0 days/year (also with residency) |

| Lithuania | ~15% (reduced rates possible) | Varies | Yes | 0 days/year (also with residency) |

| Montenegro | 9%–15% | Low (structure-dependent) | No | Min. 90-180 days/year (with residency) |

Note: Rates are simplified and may vary by specific conditions, residency, treaties, distribution type, and legal structure.

Reality Lookout for 2026

“Lowest tax” is only helpful if the structure is sustainable and compliant. In 2026, authorities will look at:

- Where you live (personal tax residency)

- Where management decisions are made (corporate tax residency risk)

- Where the business operates (permanent establishment risk)

- Substance (office, staff, director activity, contracts)

For most EU-focused entrepreneurs, the strongest “low tax + practical” options are typically: ➔ Company setup: Bulgaria, Romania, Hungary, Serbia, Croatia, How to start a business in Bulgaria and How to start a business in Romania The right business model, location, and growth strategy for your business.

We answer all your questions about a European company setup – free of charge and without obligation.

Inquire now

Over 500 successful foundings. Answer in 24h.

Or give us a call: +49 (0)89 90 42 23 60

(NEW: Company formation including bank account opening 100% remote)

Derrick

Published on 22 December, 2025 / Answer

Moving to Bulgaria and 7,5% seems reasonable to me. No minimum stay, so I can travel and be all the time at nicer places places, am I right?

Charles

Published on 23 December, 2025 / Answer

It's a coincidence...I have actually been doing that since 3 years. Having the residency in Bulgaria since 1 year, before I has digital nomad. But that doesnt work well with the banks anymore. I found a cheap apartment just for 100 EURO per month to have a resident address. Yes you dont need to be in Bulgaria not even 1 day per year and I handle my clients with my Bulgarian company and pay around 8% tax with everyting.

Kermito

Published on 23 December, 2025 / Answer

And how is it possible without residency in Bulgaria to lower the tax to 10%, instead of 15. Or in Romania 10% instead 20-30%?

Thomas Hofmann

Published on 23 December, 2025 / Answer

After you have formed a Bulgarian or Romanian company, you apply for a residency. Personal income tax in both countries is only 10%. So if you have personal income abroad, you can declare it on your personal income tax.

Leave a comment